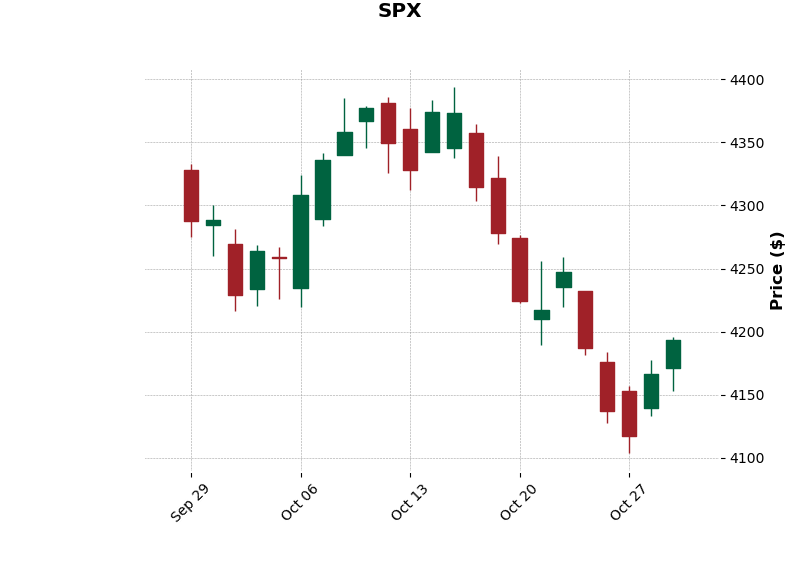

It has been a rough month for the investors of S&P 500!

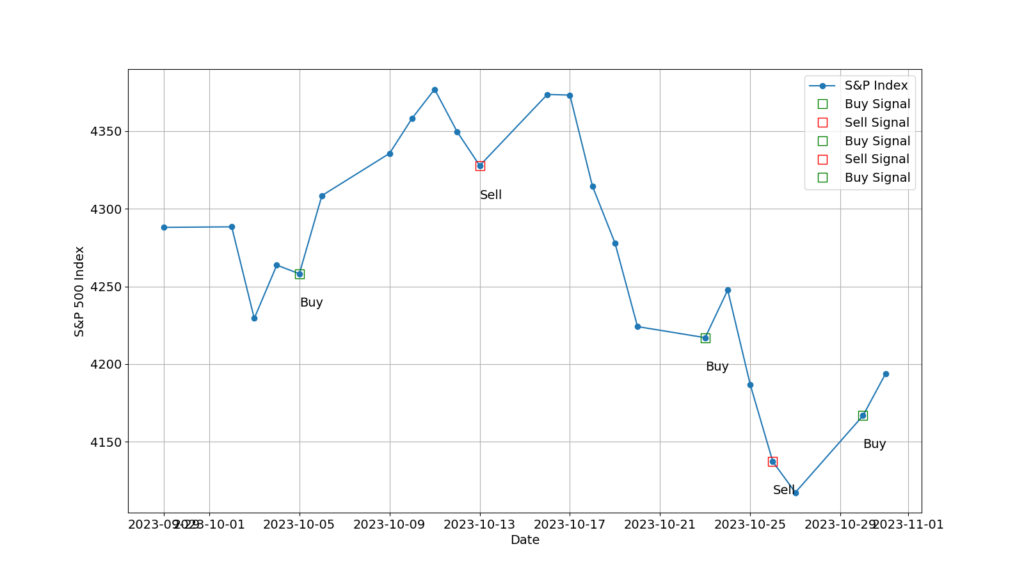

Since the beginning of October, S&P 500 index has dropped from 4288.05 to 4193.80, a change of -2.2 percent. For the same period, the tactical strategy has yielded a return of 0.4 percent. Once again, the strategy has demonstrated its power to beat the market return substantially.

The index closed at the high of the month on October 11 at 4376.95. It then dropped to the low of the month on October 27 at 4117.37. We started the month with the all-cash position. We have seen multiple buy and sell signals in the month. A buy signal was triggered on October 5. We purchased the index at the market close with the index price of 4258.19. A sell signal was triggered on October 13. We exited the position at the market close with the index price of 4327.78. A buy signal was triggered on October 23. We purchased the index at the market close with the index price of 4217.04. A sell signal was triggered on October 26. We exited the position at the market close with the index price of 4137.23. A buy signal was triggered on October 30. We purchased the index at the market close with the index price of 4166.82.

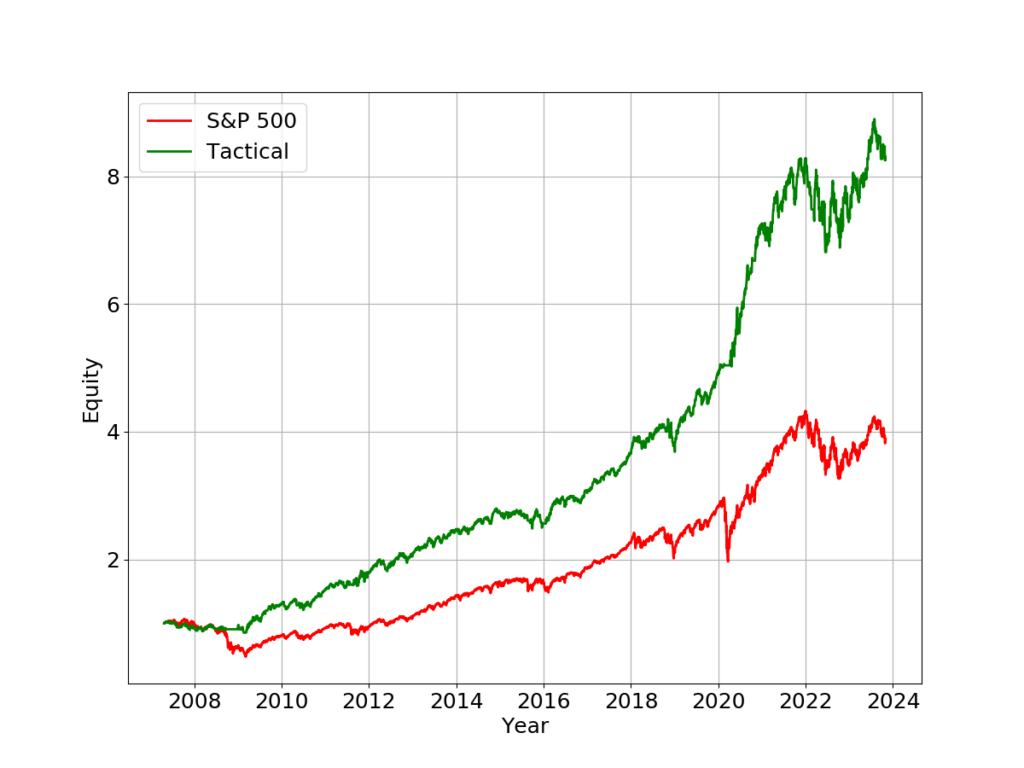

Since the inception of the strategy in 2007, the capital gain of the S&P 500 index (excluding dividend) is 302.1 percent. The return of the strategy during the same period is 730.1 percent. The strategy has outperformed the S&P500 index return by 141.7 percent.